-

Fitness: An Introduction

Getting started is one of the hardest things about working out. There’s so much information out there about what you should and should not do, and most of it is contradictory. However, there are a few simple things that you can do that will help you make a lot of progress from square one, and get you well on your way in your journey.

The things that I have found to make a huge impact on both my fitness and my clients’ are:

- Stretching and mobility

- Diet and tracking

- Strength training

- Cardio training

Focusing a little bit of time and energy on learning about each of these things and doing them well makes a big difference. The biggest deciding factor in whether or not you succeed is how well you execute every day. As Will Smith said,

“You don’t set out to build a wall. You don’t say ‘I’m going to build the biggest, baddest, greatest wall that’s ever been built.’ You don’t start there. You say, ‘I’m going to lay this brick as perfectly as a brick can be laid.’ You do that every single day. And soon you have a wall.”

Almost everyone that I have worked with has been shocked to see how much progress you can make by getting up every day, go through a good stretching routine, eating properly, and working out. This alone won’t get you a Mr/Mrs Olympia title, but doing a few relatively simple things well can get you pretty far.

-

Finding a Good Credit Card For You

Your credit report

Most credit cards are for specific types of customers. If you apply for a card that is way out of reach for you, you’ll get rejected, which can be a negative on your credit report, so if you are nowhere near the requirements for a credit card, you probably want to work on addressing that before you apply. However, having a credit card that is far below what you qualify for typically results in leaving benefits on the table because the benefits on higher tier cards are usually a lot better than beginner cards. A quick internet search can usually give you a pretty good idea of what the requirements are for a given card.

What you spend your money on

A major component to picking the right credit card is figuring out what areas you spend the most money on, and finding a credit card that offers rewards for those categories. For instance, if you spend most of your money on restaurants and grocery stores, you’ll probably get more rewards from a credit card that is tailored towards restaurants and grocery stores than one that offers its rewards on office supplies. Try making a note in your phone whenever you spend money if you aren’t sure where you’re spending your money. Bonus points if you make a budget and track all of your spending!

How much money you spend

The more money that you spend, the larger the impact of the credit card that you have. If you’re spending $200 per month on your credit card and are missing out on an extra 2% that you could be getting from a different credit card, you’re only missing out on $4/month, which is not ideal, but also not worth losing sleep over. However, if you’re spending $20,000 per month, all of a sudden you’re missing out on $400/month, or $4,800/year.

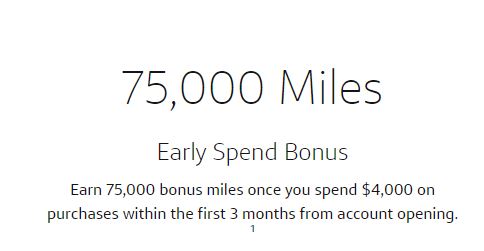

In addition, some cards offer very attractive signup bonuses when you spend a certain amount of money within a few months of signing up for the card. Almost all of these companies only offer one chance at the bonuses, so it is important to consider your ability to meet that spending requirement when making that decision.

Benefits vs Fees

Many credit cards offer benefits like perks, rewards, and credits. Many of the cards that offer good benefits also charge a fee. So how do you know which one to get?

You start crunching some numbers. First, you want to go through and make a list of all of the benefits that the credit card has to offer. Then you want to figure out which ones apply to you and which ones don’t. The credits are pretty easy to figure out because they are a specified dollar amount.

Rewards are slightly more difficult to account for, but it comes down to relatively simple math; you figure out roughly how much you spend in the categories that you’re comparing, find the difference in rewards between the cards that you’re comparing, and then multiply that difference by how much you spend. Let’s say that you’re comparing two cards that offer cash back on restaurants and groceries. You spend about $5,000 per year in a given category, and one card offers 4% back and the other offers 2% back. If you multiply the $5,000 that you spend by the 2% difference between the two, the difference accounts for about $100 per year.

Soft perks (lounge access, hotel elite status, etc.) can be trickier because they are very subjective. For instance, some people absolutely swear by airport lounges, while others are not impressed by them. You will have to do some soul searching to determine you feel about these perks and how relevant they are to your life. If you are a frequent traveler and usually stay in higher end hotels, you’ll likely get more value out of hotel elite status than someone who rarely travels and/or sticks with AirBnb or motels, especially if you really enjoy the higher status benefits.

*Worth noting*

Some cards charge fees on foreign transaction, so you should look into that if you travel abroad often and are planning to use that card on your trip. Additionally, not everywhere in the US accepts American Express and Discover, and it’s not uncommon for foreign businesses to not take them, so having either at least one card that’s Visa or Mastercard is a probably a good idea, especially if you are planning to travel abroad a fair amount.

Once you have a reasonable idea of the value of the benefits, you can subtract any annual fee on the card to get a final total of the rough value that the card will bring you. You can then use that to compare different credit cards or decide whether a certain card is good for you. It may seem complicated at first, but it gets easier with practice, and in no time, you’ll be able to skim a credit card offer and figure out if it makes sense for you.

Now that you know what to look for, you can check out our favorite cards here!

-

Rewards, Credits, Perks, and Fees

What do credit cards offer you?

Many credit cards offer benefits to users in order to attract and retain users. After all, the credit card companies don’t make any money if they don’t have any customers. So what benefits do they offer? Most of these benefits fall into the category of rewards, credits, or perks.

Rewards

Credit card rewards are the points/cash back that many credit cards offer. This can be something like “3% cash back in grocery stores” or 4 points for every dollar spent in restaurants.” For more info on rewards, check out the post about it here.

Credits

Some credit cards also offer statement credits. Statement credits may be spending-based (spend $500, get $50 back) or store-based (get a $200 annual credit when you book a hotel through the Amex Travel portal). When I am evaluating a credit card, I usually figure out how much I can save with the credits that I will use in my normal life without having to jump through too many hoops like spending too much money or shopping at some random place.

Perks

Some credit cards (usually higher tier cards) also offer perks. These perks usually are harder to value than the credits and cash back because there is rarely a dollar amount attached to them the way that there is with credits and cash back. For example, some cards come with access to airport lounges. With a perk like this, you’ll have to consider things like whether there is a lounge in the airports that you frequent, how often you travel and will be using the lounges, and how much the lounge means to you. When I was flying from Australia to New York, having lounge access during a 10 hour flight delay (which allowed me to shower and get a fresh meal) was worth every penny and then some. However, if you primarily fly short routes between small airports, lounge access may not be worth much to you.

Fees

Many credit cards charge annual fees. These range from $95 for the Chase Sapphire Preferred or the Capital One Savor to $695 for the Amex Platinum. The Amex Centurion card (an invite-only card for high net worth individuals) comes with an eye-watering $5,000 annual fee. When considering whether a certain card is right for you, the annual fee can make a big difference in that decision.

How I Evaluate a Credit Card

When I am trying to figure out if I should get a particular credit card, I gather up all of the information that I can on the card, such as rewards, credits, perks, and fees. I start by comparing the annual fee to the credits and perks to see how much value I am getting out of the card versus how much I am spending. I also compare the rewards categories with how much money I spend on those categories.

For instance, I was looking at the Hilton Aspire card recently. The Aspire card offers a free night, $250 Hilton statement credit, a $250 airline fee credit, and Diamond status with Hilton (which offers things like access to their executive lounge, late checkout/early check-in, and room upgrades). The card comes with a $450 annual fee, and offers 14 points per dollar spend at Hilton hotels, 7 points on flights, dining, and car rentals, and 3 points everywhere else.

The rewards categories aren’t awful, but I have other cards that offer better rewards points on every category besides Hilton, which is not a huge portion of my spending. So far, not interested in the Aspire.

The credits and Diamond status, however, were a different story. By using the credits alone, I can save $500, making the card worth its annual fee. In addition to this, I can save hundreds of dollars with the free weekend night (depending on the cost of the hotel where I use it). I also get more comfort when I stay at Hilton hotels via the room upgrades and lounge access. As an added bonus, I can combine the 14 points per dollar that I get for having the Aspire card with the 20 points per dollar that I get for having Diamond status, and end up getting 34 points per dollar that I spend with Hilton, which translates to about 17% back. Not a bad deal at all.

In this situation, it is important to consider how often you’ll use the rewards that are offered. If I don’t use the airline fee credit or stay at Hilton, I end up shelling out $450 for nothing, which is definitely not ideal. However, if I do use at least the free night and the Hilton credit, I am covered.

It’s a lot to consider, and it takes some forward thinking and awareness. However, there are some options out there that offer tremendous value if they are a good fit for you.

-

Credit Card Rewards

The Main Rewards Types

Many credit cards offer rewards that are based on spending as a way to encourage users to spend more money on with their credit cards. Credit card companies collect fees from the businesses who accept credit card payments that are a percentage of your payment, so it is in their interest to have their customers spending money.

Most credit cards that offer rewards offer one of two reward types: cash back or points (which may also be called miles, depending on the credit card). These rewards are typically based on specific spending categories, such as grocery stores, restaurants, and travel.

Points vs Cash Back

So what’s the difference between cash back and points? Cash back gives money back based on your spending. This cash back is stored in your account until you choose to use it. Using it allows you to lower your credit card bill.

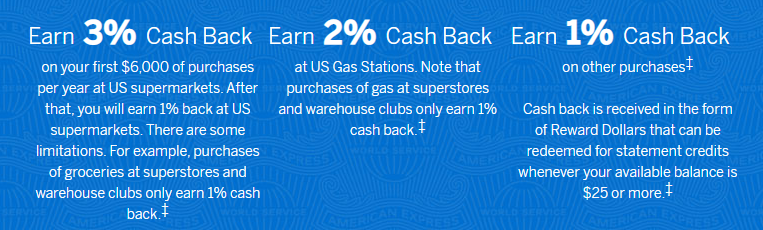

Blue Cash Everyday card cash back breakdown via americanexpress.com Similar to cash back, rewards points are typically earned by spending money with your card. However, points generally offer more flexibility in how they are redeemed. Depending on the card, points can be redeemed for things like plane tickets and hotels, gift cards to certain businesses, statement credits (which act like cash back by lowering your credit card bill by a certain amount), or other things. Unlike cash back, which has a set redemption value (spending $1 earns you $0.01 off your bill for every 1% cash back that your card offers), points can have different values depending on how they are used.

American Express Gold Card rewards points breakdown via americanexpress.com Valuing Points

Unlike cash back, which has a set redemption value (every spending $1 earns you $0.01 off your bill for every 1% cash back that your card offers), points can have different values depending on how they are used. Some credit card companies, like American Express, Capital One, and Chase, allow you to transfer rewards points to different companies, such as airlines and hotels. If you use these transfer partners wisely, you can get great deals on travel – much better than if you were getting cash back. On the flip side, if you aren’t careful, you can get significantly less value out of these points.

Let’s look at an example of this. I was looking at my American Express account the other day and noticed that I have a lot of rewards points. The two options that I was considering were to redeem them into my brokerage account at Charles Schwab, which would get me 1.1¢. I was also looking at a flight to Hawaii. I could pay roughly $1,800 cash for the flight, or use 108,000 Delta Skymiles to book it. I don’t have any Skymiles, but I do have that many American Express points, which can be transferred to Delta. So what do the numbers look like?

If I transfer my Amex points to Delta, I can spend 108,000 points to get an $1,800 flight. This would get me about 1.6¢ of value per Amex point by saving me the $1,800 that the flight would have cost me. ($1800/108000 points). If I redeemed those points into my brokerage account, I would be getting 1.1¢ per point, or $1,188 total if I redeem the 108,000 points into my brokerage account.

As you can see, the way that you use your rewards points can have a significant impact on the value that you get from them.

Intro Offers

Many credit cards also offer introductory bonuses when you first open an account. This typically takes the form of “spend a certain amount of money within a certain amount of time and we’ll give you a reward.” These can be great if the card is a good fit for you and you are planning to spend that amount of money already.

Capital One Venture X intro offer via capitalone.com Which is Better: Points or Cash Back

This answer depends on your financial situation. Cash back can be thought of as a discount on purchases, and can be helpful if you are strapped for cash because it allows you to use cash back instead of actual cash if you are in a pinch. Because of the possibility for higher redemption value, points can often provide a better return if you are not as worried about having the cash to pay your credit card bill. *While many points-based cards offer the option to redeem points for a discount on your bill, this is often a low-value way to redeem points, so you should always do the math on the different options available.*

Many of the highest redemption value options for points are for travel, so if you are a homebody, it is worth doing the research to see what redemption options you will actually use because a cash back card may end up be a better fit for you than a card that offers points.

I find that the best way to compare rewards programs is to figure out a rough value of the points that each choice offers, and then compare that to the cash back that is offered. If a card is offering 4% cash back or 4 points per dollar and I can get roughly 1.5¢ of value from each point, those 4 points will get me roughly 6¢ per dollar spent as opposed to 4¢ per dollar if I choose the cash back card. I can then use that to compare the rewards more easily!

-

Authorized Users

So what is an authorized user?

An authorized user is someone who is added to another person’s credit card account, which allows the authorized user most of the same rights as the account owner (primary card holder), such as cash back on spending and perks for cardholders. Typically, authorized users get a credit card similar to the primary account holder’s with their own name on it

What are the pros and cons?

Pros:

- Build credit: the main benefit that is typically associated with authorized users is that it allows them to build their credit by having their credit linked to that of the account owner. *This can be a double-edged sword because if the account owner has any issues with their credit, they will also appear on the authorized user’s credit report. For instance, it is not uncommon for a parent to have a balance on their card that is manageable for them, but massive for their child who is earning significantly less. Things like this can be a red flag for lenders, so it is important to consider the primary cardholder’s credit report when deciding on becoming/adding an authorized user.*

- Rewards spending/perks: many credit cards offer perks and/or rewards spending to users, such as cash back on when you use your credit card at certain businesses, free checked bags on certain airlines, etc. Many of these cards also come with an annual fee. In order to maximize the use of these benefits, some people add family or close friends as authorized users so that they can all maximize their use of benefits and rewards and split the annual fee. *Some companies charge a fee for authorized users, so it is important to read the fine print.*

- Convenience/emergencies: it is fairly common for parents to add their kids as authorized users so that their kids have a credit card with them at all times without the parents having to give up their cards. Often times, the parents have terms with their kids about what this card can and can’t be used for, such as gas or sending their kids to pick up groceries or takeout vs a mall trip.

Cons:

- Negatives on the primary account holder’s credit: if the account owner has any issues with their credit, they will also appear on the authorized user’s credit report. For instance, it is not uncommon for a parent to have a balance on their card that is manageable for them, but massive for their child who is earning significantly less. Things like this can be a red flag for lenders, so it is important to consider the primary cardholder’s credit report when deciding on becoming/adding an authorized user. These do, however, come off the authorized user’s credit report when they are removed as an authorized user.

- Being at the mercy of your authorized users: as almost every parent who has added their child as an authorized user can tell you, teenagers and college students almost always have a different definition of when it’s an acceptable time to spend their parent’s money. Many credit card companies allow you to set a limit on how much authorized users can charge to their card, but it is important to recognize that as the primary account holder, you’re responsible for the charges that authorized users put on the card, and it will affect your credit.

Bottom line, adding authorized users has its benefits and risks. It is important to recognize how much you trust the person who you will be sharing a credit card with because the actions of either party affects the other’s credit score. It is also important to read the fine print and become familiar with the terms when weighing the pros and cons.

-

Credit Scores

I keep hearing people talk about their credit scores. What are they?

Credit scores are the way that banks keep track of a bunch of the things that they look for when deciding whether or not to give you a loan, such as a mortgage, car loan, or credit card. Outside companies called credit bureaus compile all of the info that shows up on your credit history and banks access that info when you apply for a loan.

How are credit scores calculated?

Credit scores are based on five main factors (ranked in order from largest to smallest impact on your credit score):

- Payment history (35% of your credit score): credit card companies care a lot about how reliably you make your payments because if you don’t pay back your debts to them, they lose money. They like to see that you make every payment on time, and if you miss payments, they take notice of that.

- Amounts owed (30% of your credit score): having too much debt can make it difficult to pay off your loans, so credit card companies look at how much credit card debt you have when they are making the decision to approve or deny you. This also includes comparing your debt to your income, and also how much of your available credit you’re using (credit utilization). Typically, anything over 30% credit utilization is viewed as a negative.

- Length of credit history (15% of your credit score): as we remember from math class, having a larger sample size tends to yield more accurate data about a topic. Credit card companies look at things like how long you’ve had your oldest account, the average age of each of your accounts, and your newest accounts. Longer credit history means more data for them, so that is usually a plus in their eyes when making the decision.

- Types of credit accounts (10% of your credit score): credit card companies also look at the different types of loans that you have, such as car loans, student loans, and mortgages. This can give companies an indication of how well you manage your different accounts and overall credit.

- New credit accounts (10% of your credit score): having too many recently opened accounts and/or hard inquiries (when a company requests to look at your credit information, also known as a hard pull) can be a potential red flag to companies.

Credit scores allow lenders to get a better overall idea of what you’ll be like as a borrower. Certain credit cards have specific credit score requirements, so it’s worth doing your homework on that when you’re researching a credit card. Even if your credit score isn’t what you would like it to be, you can improve it by making consistent payments and lowering your credit utilization and allowing a positive credit history to grow with each passing day. For more information, check out www.experian.com.

-

Credit Cards: Pros, Cons, and Some Terms to Know

What is credit?

In short, credit is a loan. In the context of credit cards, the way that a credit card works is that a bank gives you a line of credit (a loan with a preset limit that you have the option to borrow from at will). They also give you a credit card, which allows you to access the money from that line of credit by using the card. In exchange, you pay interest on the balance (the amount of the loan that you have used and not paid back). The interest rate that you pay is specified in agreement when you get your credit card and is called the Annual Percentage Rate (APR). Typically, credit cards only charge interest on balances that remain after the payment due date every month, meaning that if you pay off your credit card in full every month, you won’t owe interest. While you can opt to not pay off your card in full every month, you must pay at least the minimum payment to avoid a penalties. This can be found on your statement or on the app/website where you pay your bill.

Should I get a credit card?

It depends on your individual circumstances. Here are some pros and cons of them to help you make a good decision.

Pros:

- Fraud protection: if someone steals your credit card info and uses it to make fraudulent purchases, as long as you report it in a timely fashion to your credit card company, you are not on the hook for the fraudulent charges.

- Earn points/cash back: Many credit cards offer rewards to users such as cash back on money spent via the credit card or points that can be redeemed for things like travel.

- Build credit: your credit history is used by companies when they are trying to determine if they should loan you money, such as when you are applying for a mortgage or a car loan, so building a *good* credit history can help with these loans.

Cons:

- Potential for mounting debt: if you accumulate too much debt, it can become a huge problem, both for your personal finances and for your credit score. With great power comes great responsibility.

- Fees: some credit cards come with annual fees, and many come with penalties for missed payments, so if you aren’t careful, your credit card bills can add up fast.

- Fine print: this is a double-edged sword as the fine print in your credit card agreement may contain things like hidden fees and penalties, as well as hidden hoops to jump through for things like cash back or intro offers. However, many cards also offer things in the fine print such as travel insurance, extended warrantees and return periods, and rental car insurance. For this reason, it is important to read through all of the fine print when making decisions about credit cards.

As you can see, there is a lot to consider when making the decision about applying for a credit card. It can be a powerful tool to enhance your life, but if used improperly, it can cause great harm, so it is important to use credit cards wisely if you do end up getting one and to live well within your budget.

-

Planning For Retirement

Okay, for the most part, this stuff makes sense. How do I put it all together though?

Here’s how I handle planning for my retirement:

- Put money in my retirement accounts (IRA and 401k in my case) so that I can take advantage of the tax benefits

- Invest that money into index funds like the S&P 500 and the Nasdaq 100 so that I can reap the benefits of diversification

- Make sure that the retirement money comes out of my paycheck before I see it so that I don’t register it in my mind as income (when you take money directly out of your paycheck, you mentally readjust your income to exclude that money from your total income, so after a few paychecks, you become accustomed to your “smaller” paycheck and adjust your lifestyle accordingly)

- Save up some extra money on the side (odd jobs, gifts, etc.) that I can use for additional saving/investing or for a rainy day

- Increase my savings and retirement contributions whenever my income increase

- Let compounding growth work its magic

How do I know how much I should contribute?

First off, you’ll have to do some self-reflection to figure out what kind of lifestyle and budget you’ll need when you’re retired. If you want to drive a new Mercedes and have a vacation house somewhere that’s warm year-round, you’re going to need more money than someone who is comfortable with a Toyota with 200,000 miles on it. Figuring out which category you fall into is important.

Once you figure that out, you’ll want to start making a list of things that you think you’ll spend money on when you’re retired. It doesn’t have to be exact, just a ballpark estimate. You can often get a pretty good estimate of this by looking at your own current spending, talking to people who have a similar lifestyle to the one you’re looking for, and doing a little bit of research on the costs of the things that you want to have in your life.

Once you have a ballpark estimate of how much you want your retirement income to be, you can divide your goal income by 4% (.04) to get a pretty good estimate of how much money you’ll have to have saved up to pull out your desired income every year. From there, you can use a Future Value of Annuity Calculator to figure out how much you should be contributing every year to reach your goal.

For the rate section of the calculator, I assume that my investments will grow by about 10% per year on average because that is right around what the long term average return for the S%P 500 is. I then subtract 2% from that to account for average inflation, and then use the 8% as my rate. *Just because these assumptions were true in the past does not mean that they will be true in the future. This is me assuming that things in the future will continue to be more or less like they have been in the past, not guaranteeing it.*

And there you have it. It’s not sexy to save for retirement, but if you save early, save often, and give your investments time to grow, your little snowball will become an avalanche before you know it.

-

Choosing Your Investments

So how do I choose what to invest in?

For most of you, you don’t have to worry too much about choosing your investments yourself – chances are, your 401k/403b will come with a financial advisor who manages your account for a small fee, and they can help you figure out how to structure your investment portfolio. You can usually also open an IRA with them and they can manage that as well. This section is just here to help you learn about some of the basics so that you can have an informed conversation with them.

Choosing your investments requires a bit of self-awareness and reflection. In order to figure out what to invest in, you have to consider a few things:

#1 How close am I to needing this money?

#2: Would I rather have a less growth potential but less fluctuation in my account balance or more growth potential and more fluctuation?

Your advisor will probably have some sort of questionnaire to help guide you through this part; however, you’ll want to give it some consideration ahead of time.

Some different investment options:

*In this section, “funds” refers to both ETFs and mutual funds.*

Target date funds: Target date funds are funds that invest in both stocks and bonds. Each fund offers many different dates that are meant to be your target date for retirement. For example, if you are planning to retire in 2060, you would invest in a 2060 target date fund. These funds automatically adjust the allocation based on how close the target date is. In essence, they do all of the work for you, but you’ll probably will leave some growth on the table because they’re fairly conservative and won’t use dividend funds or covered call funds if interest rates are low. However, they’re better than leaving your money in cash for your whole career or losing it all by buying the wrong stock.

Equity funds: Equity funds invest in stocks with the goal of growing your money. The flip side of this is that they also tend to have the most fluctuation and rely on your money remaining invested to grow. Some offer dividend payouts, but the main goal usually is growth potential, not the dividends. Equity funds are usually best for money that you’re not planning to use for a while, such as when you’re young and a long way from retiring.

Bond funds: Bond funds invest in bonds and pay out the interest that is received from the bonds. The prices and returns of bond funds will fluctuate, but payouts are usually more predictable than some of the other funds. Their payouts and growth potential are the highest when interest rates are high, and the lowest when interest rates are low.

Dividend funds: Dividend funds invest in stocks that pay dividends. Dividend funds tend to offer a better payout than bonds when interest rates are low, but a worse payout when interest rates are high. The payout tends to vary more than bond funds because companies can adjust their dividends at will, whereas bonds come with a specified interest payment. Depending on the state of the economy, this can be a good or a bad thing.

At the moment, my portfolio is entirely invested in S&P 500 funds (ETFs in my IRA, mutual funds in my 401k). I’m not planning to use that money for a few decades, so I am comfortable with having it invested for the long-haul. My logic for centering my retirement investments on the S&P 500 is that it allows me to invest in many different companies and industries at once. If one company or industry struggles, there are plenty of others that can help balance things out a bit. Investing in one company may seem appealing, but to me, running the risk of losing my entire investment is more risk than I am willing to take. It is possible that the entire US economy goes belly up and the S&P 500 becomes worthless. However, in that scenario, I’m guessing that I’ll have bigger fish to fry than how my retirement accounts are faring. As I get closer to retiring, I’ll begin shifting my money out of equity-based funds and into income-based funds like dividend and bond funds so that I have more cash available for withdrawals.

-

Dollar Cost Averaging vs Buy The Dip

So the market moves in cycles. How do I know when I should start buying?

There are common methods that are used for this:

A) Buying the Dip: When your chosen investment falls by a certain amount (aka the price dips), you start buying. People often choose different criteria for what they consider “the dip,” such as the price falling 5%, 10%, or 20%.

or

B) You can invest your money a little bit at a time at a set interval so that you’re buying at a bunch of different prices. This allows you to take advantage of lower stock prices when they do arrive without having to worry that you’re waiting for a price dip that never comes.

So which method tends to perform better?

As you can see from the chart, dollar cost averaging tends to perform better over the long run. One of the big reasons for this is that if you’re buying the dip, you might have to wait a while to invest your money, and things can move a lot higher in the meantime. If you are waiting for the your chosen investment to fall 10% and over the course of a few years, it goes from $100 to $200 to $180, your purchase price is $180 (10% lower from $200). If you buy a little bit every time you get your paycheck, you are getting some for $100, some for $103, some for $107, etc. and you tend to get a much lower overall purchase price.

Dollar cost averaging is also really easy to set up, and once it is set up, you can pretty much just let it do its thing. Most brokerage companies allow you to set up a dollar cost averaging program that deposits a certain amount from your bank account into your brokerage account, and then invests that money however you want. Once you do this, all you have to do is check your accounts periodically to be sure that the everything is operating like it’s supposed to, and you’re good to go. Most 401k and 403b accounts do this by default, so once your account is set up, you can just check with your advisor to be sure that’s the case, and you’re good to go. On the flip side, if you try to buy the dip, you either have to set up a program to do the work for you, or you have to keep an eye on the market pretty constantly, which can be quite time and energy consuming.

So which method should I use?

via jordanforeman.com The way that I personally handle my investments is to do both. I take a few hundred dollars from all of my paychecks and invest it like clockwork. However, when a nice dip in the market comes along, I cut back on my spending and make it a priority to invest extra money. This way, I am getting the benefits of my money growing constantly by dollar cost averaging, and also getting some extra money invested when my favorite investments are on sale! I also enjoy the process and feeling of buying the dip, which is part of the equation. If that’s you, setting aside some extra money for buying the dip in addition to dollar cost averaging can be a great idea. If you don’t want any part of tracking the market, no worries at all; dollar cost averaging alone work just fine. The most important thing is consistently setting aside money and getting it invested so that it can grow.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.