-

The Best Workouts Aren’t About Physical Fitness

Picture this: you’re outside on a blistering summer day, doing a workout that you’re just sure is banned under the Geneva Convention. All of your muscles feel like they’re on fire, you can barely catch your breathe, you’re starting to get tunnel vision, and you’re fighting like hell not to puke. You have the vague sense that your workout partner is next to you screaming at you to keep going, but your senses aren’t working well enough for you to be sure.

Sounds like fun, right?

As a NARP (non-athletic regular person) who was caught up training with high level athletes, I often wound up being stuck doing these sorts of workouts, and let me tell you, they fucking suck. There is no way around it, especially when you’re doing it with a group and have a trainer/coach watching over to be sure that everyone is giving it absolutely everything they’ve got. These types of workouts are designed to be as physically and mentally grueling as humanly possible.

The Massachusetts State Troopers recently got into hot water for making a class of trainees do one of these types of workouts. The instructors made the recruits do bear crawls (walking on all fours without letting your knees touch the ground) for distance on hot pavement. Some of the recruits ended up with blisters on their hands and the instructors were reassigned and punished for making the recruits do this. Meanwhile, I did these a few years back, hot pavement and all, and when a couple of the parents came to pick up their kids after the workout, not one of them complained to the coach about it. They all were well-versed in the purpose behind the workout, and a few of them expressed their appreciation for the workout.

While I wouldn’t necessarily choose hot pavement as the setting for bear crawls (though I have endured them and would do them again if I had to), exercises like that are my favorites, both as a coach and an athlete.

Why do I love these god-awful workouts so much?

Because as all my Calvin and Hobbes fans know, being miserable builds character.

The beauty of these types of workouts is that they challenge not just your body, but your mind, and they push you to (and often past) your limits. We often think of our limits as being physical, but often times, they’re mental. When you believe that you can’t do something, you give up, whether you realize it or not, and it limits what you can do. However, if you can bear down, grit your teeth, and keep pushing forward, the world becomes your oyster. That is the exact skill that these workouts teach.

The first time that I did one of these workouts, it was pushing a prowler sled (seen below) with a couple of hockey players who were in significantly better shape than me. The sled was on pavement and had 180 lbs stacked on it. There were cones set up about 65 feet apart, and we would take turns pushing the sled. Person 1 would push it down, Person 2 would push it back, and Person 3 would it down. Then Person 1 would push it back, Person 2 would push it down, etc. for 7 total rounds per person. The first round was easy. The third round had you sucking wind. By the fifth round, you would throw yourself down on the ground in between your turns because your legs were on fire. By the sixth round, you’d be fighting like hell for every step. By the seventh round, it was almost impossible to pick up your leg and move it a few inches. You become acutely aware of just how much effort a single step can take, and the only thing that keeps you going is the voice in your head (that is actually from your coach screaming at you) that is telling you to just put one foot in front of the other. You finish your last round and collapse onto the ground.

The unrivaled king of the character builders: a prowler sled via elitefts.com Before I left the gym that day, I asked the coach what muscles that workout was designed to hit. The coach grinned like the cat that ate the canary, and pointed to his head without saying a word. It would have been a perfectly scripted moment, except for the fact that my brain was still trying to figure out if I was dead or not, so I didn’t understand what he meant. He explained that the workout is great for both cardiovascular and strength work, but that the main purpose was to toughen us up and teach us how to grind through challenges. Sometimes in life, you face challenges that seem absolutely insurmountable. When that happens, you just have to focus on putting one foot in front of the other, no matter how difficult it is.

-

Why Gas Prices Fluctuate So Much

As you may have noticed, gas prices tend to change a lot and change incredibly quickly. So why does that happen?

The biggest reason for this is that the oil industry and the global economy moves in cycles. Just like the stock market moves in cycles (which you can read about here), the oil market also moves in cycles. Each stage of the cycle plants the seeds for the next stage, and right when we forget that the cycle exists, we get a sharp reminder as we transition into the next stage.

So what are these stages?

The oil market tends to follow a cheap -> expensive -> cheap -> expensive cycle. This is because when oil prices are too low, oil companies have to cut back or face bankruptcy. Employees get laid off, new exploration is halted, and expensive projects get shut down. This results in less oil being pumped out of the ground and sent to markets. When this happens, people still need oil, so prices tend to rise because there is less oil to go around. As prices rise, the oil industry begins to come back to life. Employees get hired back, the existing wells are milked for everything that they’re worth, and new oil wells are sought out. As prices climb even more, more companies start popping up, and more money gets poured into finding more oil, and eventually, this flood of new oil reaches the market and pushes prices back down. Eventually, prices get so low that the oil industry cuts back, bankruptcies and layoffs begin, and the cycle starts over again.

A significant factor in oil prices is technology. Technology can push oil prices both up and down, depending on the technology. For instance, when the world began converting from being coal-powered to oil-powered, it created an astronomical demand for oil. All of a sudden, the oil industry had customers that included governments of most of the global superpowers, and their needs were massive. This change hit just before the onset of WWII, which only exacerbated the need for oil as oil-powered ships, submarines, airplanes, and tanks slugged it out across the globe. In the end, the Allies were able to win largely by cutting off the Axis powers from oil, rendering their militaries useless.

Oil tanks burning on Sand Island of Midway Atoll after Japanese attack, June 4 1942 via WW2DB.com Technology can also push oil prices down. This can be things like breakthroughs in reducing oil consumption (hybrids, etc.) or in increasing oil production. One of the best examples of this during recent history is horizontal drilling and fracking. In the mid 2000s, advances in horizontal drilling and fracking allowed oil companies to begin to extract oil that was previously unreachable. All of a sudden, oil and gas flooded the market and in the mid 2010s, prices collapsed.

One of the other reasons for the cycle is that not all oil is created equal. Some methods of extracting and refining oil cost more than others. For instance, all else being equal, it is more difficult to extract oil from the bottom of the ocean than in the middle of Texas. This difficulty means that it costs more to get that oil. As a result, oil prices have to be at a certain level for companies to start utilizing those methods. As oil prices rise, companies start tapping into the more expensive oil production methods, and more oil gets to the market. On the flip side, those projects get cut when oil prices fall and they are no longer profitable, which decreases the amount of oil that is getting to the market, planting the seeds for the next stage of the cycle.

A Chevron deepwater platform in the Gulf of Mexico via Bloomberg These cycles are not new. In the late 1800s, a young bookkeeper began to dabble in the oil business. He started with refining, and began to expand into other areas of the oil industry. He was able to leverage his knowledge of the oil industry’s cycles to not only survive the downturns, but to take advantage of them and grow his business. In time, the business would come to be known as Standard Oil, and it’s founder, John D. Rockefeller, would become the richest man in the United States.

Rockefeller was well-known for his views of the oil industry’s boom and bust nature; namely, his desire to put an end to the cycles and create a more stable industry that would benefit both companies and consumers. Rockefeller’s approach was to build up a huge supply of cash when oil prices and profits were high, and then use that cash and any and every loan that he could get to buy out competitors when times were tough. He also would flood the market to drive down prices when he needed to, and in time, built up a stranglehold on the industry by controlling every part of it. He had arrangements with the railroads that got him discounts because of how much business he provided, he controlled the pipelines, refineries, drilling sites, and distribution centers. He used this stranglehold to try and stabilize the industry so that companies and consumers could have stable, predictable oil prices, rather than facing the wild gyrations that caused so much disruption. Rockefeller and Standard Oil were relatively successful at stabilizing the industry for decades, but the breakup of Standard Oil and the growth of the oil market from a national to an international one broke Standard Oil’s control.

Alas, the more things change, the more they stay the same. The cyclical nature of the oil industry persists, and just as Rockefeller fought to stabilize the oil markets in his day, many of the world’s governments now fight the same fight. Many countries produce oil, and they fight amongst themselves and with their customers to make the largest possible profit. Alliances like OPEC+ are formed, and agreements are signed and then circumvented when there are profits to be made. As we have seen between early 2020 and now, the world alternates between having oil gluts and oil shortages, just as it has since Edwin Drake’s discovery in Titusville, PA. Just like in the stock market cycles, the root cause for these boom and bust cycles is the fear and greed cycle that is inherent to human nature, and will likely continue as long as humans use oil.

-

Someone is Making More Money Than God, But It’s Not Exxon

*All of the figures in this post are adjusted for inflation for the sake of easier comparison*

Democrats have been criticizing US oil companies recently for raising oil prices, an anti-price gouging bill was shot down in Congress, and President Biden railed against the oil companies and their profits, targeting Exxon specifically because they “are making more money than God.” I’ve had a flood of questions about these things, so we’re doing to dive into it, starting with Exxon and their profits.

While Exxon and the other US oil companies are enjoying profitable years so far, they aren’t making outlandish profits. Exxon’s net income over the past year (the total amount of money that a company earns minus expenses) has been similar to some of their lowest earning years over the past two decades, and less than half of what they have made in their better years over the same time period.

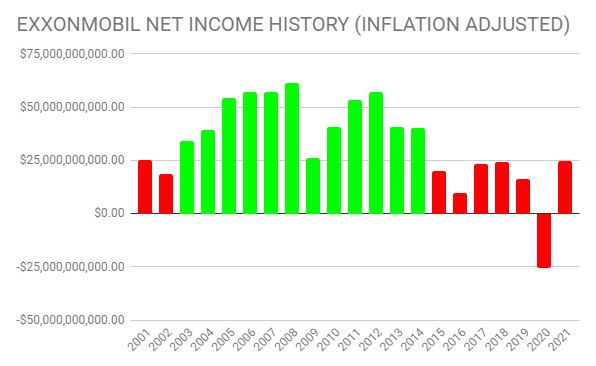

EXXONMOBIL net income history adjusted for inflation. Green bars are years when earnings were higher than $25.79 billion (Exxon’s net income over the past year), red is lower than $25.79 billion. If things continue more or less the same way, Exxon will bring in a net income of roughly $25-26 billion in 2022. As you can see from the graph, Exxon brought in more than that in every year from 2003 to 2014. You would be correct in pointing out that oil prices were not low in those years, but they were not nearly as high as they are now. In 2010, Exxon made $40 billion (a bit less than double what they’re projected to bring in this year) with gas prices at around $3.74 per gallon compared to $5.00 today. In 2012, when gas was at $4.71 per gallon (the closest we’ve got to today’s prices), Exxon brought in $57 billion. For those of you following along at home, that is a lot more than they’re on track to make this year, even with gas prices higher now than in 2012.

So what? It seems like Exxon is making a ton of money this year.

First off, we can dispel the myth that Exxon is actually bringing in record profits. That is a combination of executives on the company’s earnings call and the media trying to create a story out of thin air. As an executive at a big company, part of your job is to make your company appeal to investors. This is done by spinning everything to sound 10x better than it actually is. Every quarter is described at minimum as “strong,” regardless of how the company fared, any bad results are blamed on external forces that are beyond the company’s control, and any halfway decent quarters are described as though the company discovered the cure for cancer. Accounting practices also allow just enough wiggle room for companies to tease the numbers a bit to make a horrendous quarter look okay, and an okay quarter look absolutely incredible.

The media has also had a field day with headlines about Exxon bringing in record profits. A quick Google search shows headlines from NPR, USA Today, The NY Times, and Reuters (to name a few) about how Exxon is bringing in record profits. The problem is that they bury in the fine print that what they actually mean is that Exxon has recorded their biggest profit since 2017 (assuming that you account for inflation). Even if you don’t account for inflation, Exxon still brought in more in every year from 2003-2014 than they are right now, which by definition, means that they’re not making record profits.

We can also see that Exxon has made far more money with far lower oil prices. We’ll get into this deeper in the next post, but a big part of the reason for this is the cost of extracting oil and gas. There are many different costs associated with extracting oil and getting it to the market, and these costs can vary greatly. When costs are low, you can get oil and gas to the market cheaply and still make a decent profit. When costs are high, you can’t do that. The oil companies do have some choice in how much they sell their oil for, but a lot of that is based on how much it costs them to get the oil to the market, not them trying to bring in more money. A substantial part of the oil market is based on companies trying to offer the lowest prices to entice more customers, so they are constantly competing with each other and pushing prices down whenever possible.

So who is making more money than God?

The biggest company in the world at the time of this writing. And no, it’s not Apple.

Chances are, you probably haven’t heard of Saudi Aramco before. If you have, it’s probably one of those “I’ve heard the name but that’s about it” situations.

Aramco traces back to the 1920s when American oil companies (many of them offshoots of Standard Oil) began searching for oil in Saudi Arabia. Companies would buy concessions from the Saudi government, which would allow them to search for oil, and entitled them to shared ownership with the Saudis of whatever they found.

In the late 1940s, oil-bearing countries began demanding a larger cut of oil revenue from the oil companies by threatening to seize control of their assets. In 1950, an agreement was reached that would see Aramco and the Saudi government splitting oil revenue 50/50. The government would continue demanding a larger share, and eventually bought Aramco outright in 1988 and created Saudi Aramco.

Since then, Saudi Aramco has been growing like a weed, fertilized by new oil and gas discoveries and heavy investment into new projects and businesses.

So just how much are they making right now?

In the first quarter of 2022, Aramco brought in a whopping $39.5 billion of net income, bringing their total over the past 12 months to $122.2 billion. For reference, Apple has brought in $101.9 billion over that period.

With that being said, Aramco is in the same boat as Exxon in terms of their profits and oil prices. Aramco reported $111.1 billion in net income in 2018 when gas was $3.57 per gallon, which suggests that they too are a slave to other factors besides just oil prices. We’ll dive more into these factors in our next post!

-

How Oil and Gas Prices Drive Inflation

The other main way to increase inflation is by increasing the cost of the components of things. For instance, if you’re Apple and the cost of most of the materials for making iPhones increase, you’re going to have to raise your prices if you want to stay in business and keep making money.

There is one area of the economy that is often ignored by the general public but that is one of the biggest driver of cost-based inflation: commodities. Within commodities, there are two that are far and away the largest contributors: oil and natural gas.

It’s easy to underestimate how much of an impact oil and gas have on our society. We tend to think about oil as being used to make the gas/diesel for our cars and to heat our homes, and that’s about it in terms of the impact that it’s price has on our life. With natural gas, you might think of your gas stove and your gas heating system for your home, and that’s probably about it. However, while those may be the main things that directly affect us, that is only the tip of the iceberg.

When oil and gas prices go up, it creates a huge ripple effect on the economy because oil and gas are used in at least one stage of virtually anything that you spend money on. For instance, let’s say that you want to buy some fruit from the grocery store. In order for that fruit to get from a seed to the grocery store, it has to be planted by a farmer, who is probably using tractors, which use diesel. That farmer also has to fertilize the field, and that fertilizer is made using natural gas. The farmer probably will spray pesticides and tend to the crops at different points (more diesel and some aviation fuel for the crop duster), and then will use even more diesel to harvest the crops. Once they’re harvested, they get packed up into containers (that are probably made of plastic, which is made with oil), and then put onto a truck. If that fruit is ripe enough, it is then shipped to the grocery store, and the truck uses diesel for that. If it isn’t ripe enough, it is artificially ripened using one of the components of natural gas. The grocery store owner then has to use either oil or natural gas to heat the store, and pay for electricity that is likely produced by burning coal, oil, or natural gas. By the time you get your fruit, oil and gas have already had a tremendous impact on it.

This impact doesn’t only apply to groceries either. Virtually anything that requires any sort of manufacturing requires a substantial amount of oil and gas to power the manufacturing process. If you want to build a car, you need the wiring, rubber, different types of metal, paint, plastic, and many other components. Each of these these components requires fossil fuels for the production process, and then even more fuel to assemble them into a car.

Almost anything that requires electricity also requires tremendous amounts of coal, oil, and gas, so even things that are internet-based are susceptible to commodity prices. According to a report by Ericcson, each GB of data that is downloaded via a mobile network uses roughly 2 kWh of electricity. They also estimate that global monthly mobile data usage is roughly 65 EB per month (65 billion GB). Using these estimates, a 0.5¢ increase per kWh of electricity would translate to an added $650 million of electricity costs per month for mobile carriers, or $7.8 billion per year. Now, these numbers are very rough estimates, and electricity usage per GB of data has likely decreased over the past few years. The point, however, remains; when fossil fuel prices go up, so do electricity prices. When the cost of electricity goes up, so does the cost of the internet.

As you can see, the world is powered by fossil fuels, so when their prices go up, the world feels the impact of the rising prices.

-

Inflation: What is it and what causes it?

Inflation is defined as an increase in prices and/or a fall in the purchasing power of money. Simply put, if prices go up or the value of your money erodes, you’ve got inflation on your hands. We’ve seen this a LOT in the past few years, as the prices of virtually everything have gone up.

So what causes inflation?

Two main things: adding more money into a situation and adding costs to a situation.

Let’s start with adding money into a situation. We often hear that when the government prints more money, inflation happens. This isn’t wrong, but it’s not the whole picture. You can also add money into a situation by making more money available to buyers. This is primarily done via loans. Student loans and mortgages are two of the largest drivers of this. Let’s say that you want to go to college but student loans don’t exist; you have to pay upfront for it with the money you currently have saved up. Chances are, you can only afford to pay a few thousand dollars or so. Most people are in a similar situation, so colleges start charging $2,000 so that their customers can afford to attend.

Now, a few businesses and government groups get together with the colleges and discuss how they can make it easier for people to attend college. They realize that some people can’t afford to shell out $2,000, so they decide to loan people the money for college and let them pay it back over time so that they can spread out the payments into smaller pieces. Rather than paying $2,000 upfront, you can borrow $2,000 and pay it back over the course of 5 years (plus interest). All of a sudden, the people who couldn’t afford the $2,000 can afford it. However, the people who could afford it before can now afford to pay $4,000. The colleges realize that these people can afford the higher tuition, so they raise the price. The colleges realize that they just doubled their income without having to make any real changes, so they are ecstatic. They go to the government and the bankers, who are happy to be bringing in the interest income from the loans, and they try to think up a way to increase their income. They realize that if they spread out the payments over 15 years instead of 5 years, their customers can afford to borrow and shell out even more money. The colleges raise their tuition to $9,500/year, and the banks and government loan the money to everyone so that they can keep paying for school. The best part is that because you’re spreading out the payments more, your monthly payment is essentially the same as it was when you were paying $4,000/year! (You are, of course, making that payment for 180 months instead of 60 months, so you’re paying more in the long run).

Mortgages work pretty much the same way, except the housing market is even more responsive to changes in mortgage terms than the education market is because homebuyers are trying to outbid each other for houses every day, whereas colleges raise tuition more gradually. However, the end result is the same; when you give people access to more money, prices tend to go up.

One of the big ways that people access more money via loans is when interest rates are lowered. When interest rates fall, people can afford to borrow more money because they are paying less for every dollar that they borrow. This is the big reason why we tend to see inflation rise when rates are low and fall when rates rise, and why interest rates are used to help keep the pace of the economy fairly steady. When people aren’t spending money, the Federal Reserve can lower interest rates to encourage more spending, and when inflation starts to get too high, the Fed can raise rates to get people to cool their spending a bit, which trickles into the other areas of the economy and brings things back to a more manageable state.

The amount of money people spend is one of the biggest drivers of inflation, but it is not the only one. As you’ll see in this series, inflation is a messy web of interconnected factors that feed off of each other and cause loops that push the inflation rate violently in one direction for a long time, and then do a full 180 and reverse as just as violently.

-

Are Push-ups the Cure for Heart Attacks?

A study about push-ups and cardiovascular health has been making its way around the media. The gist of the findings is that men who can do 40+ push-ups have a significantly lower risk of cardiovascular events than men who can’t do 10 push-ups.

So just do more push-ups and you’ll be fine, right?

Not necessarily.

Despite what the news anchors are saying, this is probably a case of correlation, not causation. For those of you who (like me), slept through your high school statistics class, correlation means that two things tend to happen together, while causation means that one thing causes the other.

Let’s say that you notice that almost every thunderstorm happens on a day when you’re wearing shorts. You keep a tally for a year and you find out that 95% of thunderstorms happened on a day when you were wearing shorts. You think about it and you realize that it’s unlikely that your clothing choice controls the weather. However, 95% is a lot – you can’t shake the feeling that there’s a link.

While your clothing choices don’t control the weather, shorts and thunderstorms tend to go hand in hand. If you wanted to sound smart, you could say that there is a correlation between wearing shorts and thunderstorms occurring. The reason why they go hand in hand is not because your shorts control the weather, because they are caused by the same thing: hot weather.

Hot weather causes us to wear shorts because they’re better at allowing us to cool off. On hot days, more water evaporates, which creates ideal atmospheric conditions for thunderstorms, and leads to more thunderstorms. In this case, you could say that there is a causational relationship between hot weather and thunderstorms and between hot weather and shorts.

Now that we have a better understanding of correlation vs causation, let’s revisit the push-ups. Think about the people you know who can do 40+ push-ups without stopping. Most of them are probably in good shape. They’re probably lean, pretty muscular, pretty strong, and in pretty good cardiovascular shape. There’s a decent chance that their overall physical condition is the reason why they are at a lower risk for cardiovascular events, not just their push-up abilities. There are tons of studies out there that demonstrate that people who are in good shape tend to be at a lower risk of cardiovascular problems, so it would make sense if this is a correlational relationship, not a causational one. I can’t say for sure what the true answer is, but for now, I will continue to do exercises besides just push-ups.

-

HIIT vs LISS Cardio

What the hell is LISS and HIIT?

LISS stands for Low-Intensity, Steady-State. Steady-state means that you’re keeping up roughly the same amount of effort throughout the entire workout. The low-intensity part is supposed to mean that you aren’t pushing yourself very hard, but that part is often ignored because LISS is generally used to describe any type of steady-state cardio. The usual examples of LISS are things like hopping on the elliptical or treadmill and jogging for 45-60 minutes or going for a long bike ride or hike.

HIIT stands for High Intensity Interval Training, aka doing short bursts where you give it everything you’ve got and take breaks in between rounds. For instance, you might sprint for 30 seconds and then slowly walk/rest for 30 seconds. HIIT workouts are typically much shorter than LISS workouts because the HIIT work condenses your effort into a much shorter timeframe than LISS.

So which one should you do?

Both.

LISS and HIIT involve different systems in your body, so training one way does not necessarily make you better at the other. In addition, they also both offer different benefits. LISS helps to train your endurance and your body’s ability to use oxygen for exercise (aerobic), while HIIT helps to train you to be able to handle short burst of vigorous exercise and your body’s ability to perform without oxygen for short periods (anaerobic). Being good at either short bursts of exercise or long periods of exercise can make you a good athlete. Being good at both short bursts of exercise and long periods of exercise can make you a great athlete.

To give you an example, let’s look at my cousin. My cousin has dabbled in both triathlons and weight lifting, so he has a lot of experience with both short bursts of exercise and longer endurance exercise. As a result, he has become an athlete who can only be described as freakish. He can row/run/swim/bike at a pace that approaches world records during sprints while being able to maintain my all-out sprint pace for long periods when he is doing endurance training. He is also great at both lifting heavy for a few reps and lifting lighter weights for a ton of reps. He is fairly new to weight training, but has been able to make enormous progress with it because of his triathlon training, and has eclipsed a lot of the seasoned lifters he knows in less than a year.

For my workouts, I try to alternate HIIT and LISS pretty regularly. For instance, I might do 7 rounds of 30 seconds effort/30 seconds rest of HIIT on my fan bike or rower after one of my strength workouts, and then 15-20 minutes of LISS the next time where my goal is to keep my heart rate around 140-170 BPM. On my dedicated cardio days, I’ll switch between doing something like 20 rounds of 30 seconds of sprinting/30 seconds of rest for HIIT and 45-60 minutes with my heart rate around 150-160 when I do LISS. At the end of the day though, the most important thing is that you’re doing some form of cardio; the type that you do is the icing on the cake.

If you are going to do HIIT, you should check with your doctor, especially if you have a medical condition like asthma or a heart condition. HIIT is designed to be extremely taxing on your cardiovascular and respiratory systems, so these conditions can be aggravated by HIIT.

-

When Should You Do Cardio?

The Age Old Question

One of the questions that almost every gym rat I know has asked me is whether you should do cardio before or after you do your weight training.

The answer?

It depends on your goals.

If your goals involve getting stronger/more muscular/leaner, you’ll want to do your cardio after your weight training. However, if your goals are more centered around improving at cardio, you are better off doing your cardio first.

The Science Behind It

Your body has two primary methods for storing energy: fat and glycogen. Glycogen is the body’s preferred source of energy because it is very easy to convert and your body can use it very efficiently. Fat is more of a Plan B energy source because you can store a lot more of it than glycogen, but it is harder for your body to break it down and convert it to fuel. As a result, your body usually will run on glycogen for as long as possible, and then switch to burning fat once you run out of glycogen. Burning fat translates to fat loss, hence why you’ll tend to find more success with weight training followed by cardio when you are trying to get lean.

If you’re trying to get stronger or more muscular, the reason why weights first tends to work better is that your body can use glycogen much more efficiently than it can fat, so you’ll be able to get more bang for your buck when you are burning glycogen during your weight training session. If you want to see for yourself, try running a mile or two and then lifting. You’ll notice a significant drop in your weight training performance when you run first because your body is tired and has to settle for less glycogen. For this reason, if you’re focusing on strength and muscle, you’ll want to take full advantage of your glycogen supply when you lift.

On the other hand, if your main focus is your cardiovascular system, doing cardio first will likely make sense for you so that you can use your prime workout time on cardio.

It also isn’t a bad idea to include a day or two of just cardio so that you can work on developing your cardiovascular endurance. Regardless of what I am trying to do with my body, I typically throw at least one dedicated cardio day into my schedule every week. It can be hiking, basketball, jogging, bike rides, the elliptical, or whatever other method of doing cardio that you can think of. This will help loosen up your muscles and get your blood flowing a bit, as well as helping to ensure that you’re getting enough cardio in your life.

-

How Many Sets and Reps Should You Do?

So you know that you want to do some weight training. What should you do though?

First off, you want to figure out what your goal is. It could be that you want to get stronger, it could be that you want to put on muscle, or it could be both.

Reps (repetitions): doing the specified movement one time. If you’re doing squats, doing one squat means you did one rep.

Sets: the clusters of specified amount of reps. If you do fifteen squats, rest for a minute, and then do another fifteen, you have done two sets of fifteen reps.

Strength Building

If you want to get strong, focus on doing fewer reps with more weight and focus more on lifts that work a lot of muscles, mainly compound lifts like deadlifts, squats, bench press, military press. Try to do one of those lifts per workout and make that the focus of your training. For example, my bench press workout when I am focusing on strength is:

- Barbell Bench Press

- 10 reps of 135lbs (warmup set, doesn’t count towards 5 sets)

- 10 reps of 225lbs

- 6 reps with 275lbs

- 5 reps of 295lbs

- 3-4 reps of 315lbs

- 3-4 reps of 315lbs

- Barbell Bent-Over Rows

- 12 reps of 100lbs

- 10 reps of 120lbs

- 10 reps of 120lbs

- 8 reps of 130lbs

- 8 reps of 130lbs

- Upright Rows

- 10 reps of 135lbs

- 10 reps of 135lbs

- 10 reps of 155lbs

- 8 reps of 175lbs

- 8 reps of 175lbs

- Dumbbell Lunges

- 12 reps of 60lbs

- 10 reps of 80lbs

- 8 reps of 100lbs

- 8 reps of 100lbs

- 8 reps of 100lbs

- Kettlebell Swings

- 15 reps of 75lbs

- 15 reps of 100lbs

- 15 reps of 125lbs

- 10 reps of 150lbs

- 10 reps of 175lbs

The exercises that I do to build strength focus mainly on working a ton of different muscles at once. My goal here isn’t to target one specific muscle, but to get my whole body to work as one cohesive unit so that I can get the most bang for my buck. With strength, you’re only as strong as your weakest link, so if you have any muscles that are lacking, lifts that engage a lot of muscles will do a good job of exposing those weaknesses and fixing them.

Adding Size

If you want to put on muscle. you’re going to want to use less weight and do more reps. The compound lifts are important, but you’ll also want to do a lot of accessory lifts that are more specialized and work fewer muscles, such as bicep curls, lateral raises, or calf raises. When I’m trying to add muscle, my workouts look something like this:

- Barbell Bench Press

- 10 reps of 135lbs (warmup set, doesn’t count towards 5 sets)

- 10 reps of 225lbs

- 10 reps with 265lbs

- 10 reps with 275lbs

- 10 reps with 275lbs

- As many reps as possible with 155lbs

- Cable Pulldowns

- 15 reps of 100lbs

- 15 reps of 120lbs

- 15 reps of 120lbs

- 15 reps of 130lbs

- 15 reps of 130lbs

- Lateral Raises

- 25 reps of 30lbs

- 25 reps of 30lbs

- 25 reps of 30lbs

- 25 reps of 30lbs

- 25 reps of 30lbs

- Leg Extensions

- 25 reps of 110lbs

- 25 reps of 120lbs

- 25 reps of 130lbs

- 25 reps of 140lbs

- 25 reps of 150lbs

- Bicep Curls

- 25 reps of 30lbs

- 25 reps of 30lbs

- 25 reps of 30lbs

- 25 reps of 30lbs

- 25 reps of 30lbs

As you can see, these lifts involve a lot more reps, and fairly low weight. You’re definitely going to feel the last few reps and probably will be sucking a little bit of wind, but for growing your muscles, it’s all about volume; you want to do a lot of reps, and hit those muscles often.

Chances are, you’re probably looking to build both strength and size. If that’s the case, you want to incorporate both of these approaches into your training. I find that I have the most success with alternating each of them from week to week, but you can also break them up so that you’re doing a little bit of each one during your workouts. You might do a few higher-rep sets of bench press and a few lower rep ones, and mix in both barbell rows and lateral raises. Ultimately, the most successful plan is the one that you stick to, so don’t be afraid to try out both and see which one you prefer.

- Barbell Bench Press

-

Pulling It All Together

So you understand that there are a few different components of fitness. But where do you start?

Stretch every day. I have found that doing it in the morning works the best for me because my schedule is the most consistent in the morning and I usually am stiff when I get out of bed. If you are working out that day, you can either stretch in the morning, before your workout, or both, depending on how tight you are.

Eat healthy. There are probably at least 5 things that you can think of off the top of your head to improve your eating. It might be that you need to cut back on alcohol. It might be that you treat cheese like it’s own food group. It might be that you feel empty inside if you don’t have dessert every night. It could be that you don’t get enough protein or fruits and vegetables in your diet. Addressing those things can take you farther than you think. Start reading nutrition labels too and getting a sense of the nutritional makeup of different foods, especially your favorites.

Make sure that you’re getting the right amount of sleep. Shoot for around 7-9 hours.

Do some strength training. It doesn’t have to be the absolute perfect workout – start with the machines at your gym. Most of them have pictures on them that will show you how to use them. This allows you to start getting strong and putting on muscle. Ideally, you want to try and hit most of the different muscle groups. I generally use the “Push, Pull, Legs” rule for making sure that I am doing this. I do this by splitting my workouts into three groups that are roughly equal: pushing motions where you are pushing the weight away from you (bench press, shoulder press), pulling motions where you’re pulling the weight towards you (different types of rows), and exercises that work your legs (leg press, lunges). You can dedicate a workout to each group, or you can do a mix of all three groups during each workout – whichever you find works the best for you. Doing a dedicated day for each group tends to leave you more sore (especially when you do you leg day), but some people (myself included) get satisfaction from feeling extra sore. Shoot for 10-12 reps with a weight that you can do for 10-12 reps, but not many more. Do a set or two with lighter weight, and then move into your normal weight. Once you can do 12 reps consistently, increase the weight and shoot for 8-10 reps. Rinse and repeat as often as needed.

Do some cardio. It can be before your strength training, after your strength training, or on the days when you aren’t doing any strength training. Shoot for about 90-120 minutes of cardio per week, and try to rotate through different types and intensities.

This is not the most comprehensive guide to fitness. The purpose of this guide is to get you started. Keep reading and we’ll break down more info about fitness to help you continue your journey.

* We also offer personalized fitness coaching, including customized workout plans and video How-To’s for the different exercises, as well as nutrition advice. If you are interested or looking for more information, fill out the form below. As a bonus, we’ll be selecting 10 of the next 100 people to sign up and giving them 6 months of free training!*

Thank you for your response. ✨

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.