*All of the figures in this post are adjusted for inflation for the sake of easier comparison*

Democrats have been criticizing US oil companies recently for raising oil prices, an anti-price gouging bill was shot down in Congress, and President Biden railed against the oil companies and their profits, targeting Exxon specifically because they “are making more money than God.” I’ve had a flood of questions about these things, so we’re doing to dive into it, starting with Exxon and their profits.

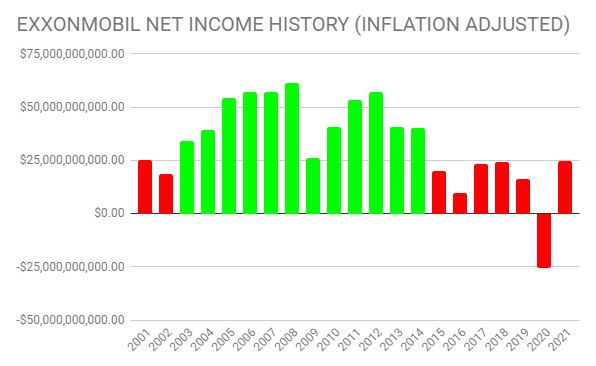

While Exxon and the other US oil companies are enjoying profitable years so far, they aren’t making outlandish profits. Exxon’s net income over the past year (the total amount of money that a company earns minus expenses) has been similar to some of their lowest earning years over the past two decades, and less than half of what they have made in their better years over the same time period.

If things continue more or less the same way, Exxon will bring in a net income of roughly $25-26 billion in 2022. As you can see from the graph, Exxon brought in more than that in every year from 2003 to 2014. You would be correct in pointing out that oil prices were not low in those years, but they were not nearly as high as they are now. In 2010, Exxon made $40 billion (a bit less than double what they’re projected to bring in this year) with gas prices at around $3.74 per gallon compared to $5.00 today. In 2012, when gas was at $4.71 per gallon (the closest we’ve got to today’s prices), Exxon brought in $57 billion. For those of you following along at home, that is a lot more than they’re on track to make this year, even with gas prices higher now than in 2012.

So what? It seems like Exxon is making a ton of money this year.

First off, we can dispel the myth that Exxon is actually bringing in record profits. That is a combination of executives on the company’s earnings call and the media trying to create a story out of thin air. As an executive at a big company, part of your job is to make your company appeal to investors. This is done by spinning everything to sound 10x better than it actually is. Every quarter is described at minimum as “strong,” regardless of how the company fared, any bad results are blamed on external forces that are beyond the company’s control, and any halfway decent quarters are described as though the company discovered the cure for cancer. Accounting practices also allow just enough wiggle room for companies to tease the numbers a bit to make a horrendous quarter look okay, and an okay quarter look absolutely incredible.

The media has also had a field day with headlines about Exxon bringing in record profits. A quick Google search shows headlines from NPR, USA Today, The NY Times, and Reuters (to name a few) about how Exxon is bringing in record profits. The problem is that they bury in the fine print that what they actually mean is that Exxon has recorded their biggest profit since 2017 (assuming that you account for inflation). Even if you don’t account for inflation, Exxon still brought in more in every year from 2003-2014 than they are right now, which by definition, means that they’re not making record profits.

We can also see that Exxon has made far more money with far lower oil prices. We’ll get into this deeper in the next post, but a big part of the reason for this is the cost of extracting oil and gas. There are many different costs associated with extracting oil and getting it to the market, and these costs can vary greatly. When costs are low, you can get oil and gas to the market cheaply and still make a decent profit. When costs are high, you can’t do that. The oil companies do have some choice in how much they sell their oil for, but a lot of that is based on how much it costs them to get the oil to the market, not them trying to bring in more money. A substantial part of the oil market is based on companies trying to offer the lowest prices to entice more customers, so they are constantly competing with each other and pushing prices down whenever possible.

So who is making more money than God?

The biggest company in the world at the time of this writing. And no, it’s not Apple.

Chances are, you probably haven’t heard of Saudi Aramco before. If you have, it’s probably one of those “I’ve heard the name but that’s about it” situations.

Aramco traces back to the 1920s when American oil companies (many of them offshoots of Standard Oil) began searching for oil in Saudi Arabia. Companies would buy concessions from the Saudi government, which would allow them to search for oil, and entitled them to shared ownership with the Saudis of whatever they found.

In the late 1940s, oil-bearing countries began demanding a larger cut of oil revenue from the oil companies by threatening to seize control of their assets. In 1950, an agreement was reached that would see Aramco and the Saudi government splitting oil revenue 50/50. The government would continue demanding a larger share, and eventually bought Aramco outright in 1988 and created Saudi Aramco.

Since then, Saudi Aramco has been growing like a weed, fertilized by new oil and gas discoveries and heavy investment into new projects and businesses.

So just how much are they making right now?

In the first quarter of 2022, Aramco brought in a whopping $39.5 billion of net income, bringing their total over the past 12 months to $122.2 billion. For reference, Apple has brought in $101.9 billion over that period.

With that being said, Aramco is in the same boat as Exxon in terms of their profits and oil prices. Aramco reported $111.1 billion in net income in 2018 when gas was $3.57 per gallon, which suggests that they too are a slave to other factors besides just oil prices. We’ll dive more into these factors in our next post!