The Main Rewards Types

Many credit cards offer rewards that are based on spending as a way to encourage users to spend more money on with their credit cards. Credit card companies collect fees from the businesses who accept credit card payments that are a percentage of your payment, so it is in their interest to have their customers spending money.

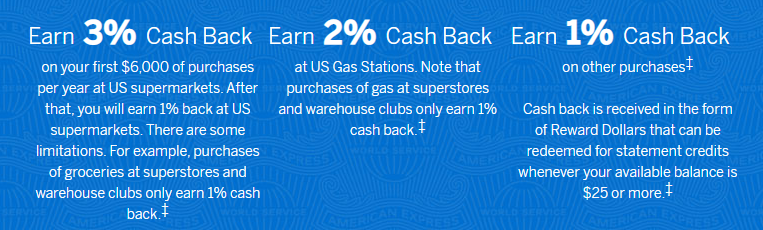

Most credit cards that offer rewards offer one of two reward types: cash back or points (which may also be called miles, depending on the credit card). These rewards are typically based on specific spending categories, such as grocery stores, restaurants, and travel.

Points vs Cash Back

So what’s the difference between cash back and points? Cash back gives money back based on your spending. This cash back is stored in your account until you choose to use it. Using it allows you to lower your credit card bill.

Similar to cash back, rewards points are typically earned by spending money with your card. However, points generally offer more flexibility in how they are redeemed. Depending on the card, points can be redeemed for things like plane tickets and hotels, gift cards to certain businesses, statement credits (which act like cash back by lowering your credit card bill by a certain amount), or other things. Unlike cash back, which has a set redemption value (spending $1 earns you $0.01 off your bill for every 1% cash back that your card offers), points can have different values depending on how they are used.

Valuing Points

Unlike cash back, which has a set redemption value (every spending $1 earns you $0.01 off your bill for every 1% cash back that your card offers), points can have different values depending on how they are used. Some credit card companies, like American Express, Capital One, and Chase, allow you to transfer rewards points to different companies, such as airlines and hotels. If you use these transfer partners wisely, you can get great deals on travel – much better than if you were getting cash back. On the flip side, if you aren’t careful, you can get significantly less value out of these points.

Let’s look at an example of this. I was looking at my American Express account the other day and noticed that I have a lot of rewards points. The two options that I was considering were to redeem them into my brokerage account at Charles Schwab, which would get me 1.1¢. I was also looking at a flight to Hawaii. I could pay roughly $1,800 cash for the flight, or use 108,000 Delta Skymiles to book it. I don’t have any Skymiles, but I do have that many American Express points, which can be transferred to Delta. So what do the numbers look like?

If I transfer my Amex points to Delta, I can spend 108,000 points to get an $1,800 flight. This would get me about 1.6¢ of value per Amex point by saving me the $1,800 that the flight would have cost me. ($1800/108000 points). If I redeemed those points into my brokerage account, I would be getting 1.1¢ per point, or $1,188 total if I redeem the 108,000 points into my brokerage account.

As you can see, the way that you use your rewards points can have a significant impact on the value that you get from them.

Intro Offers

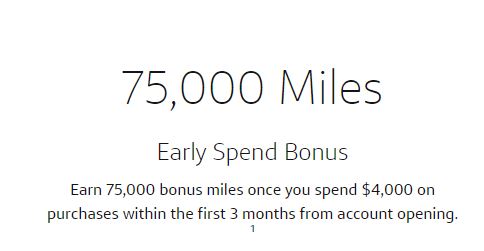

Many credit cards also offer introductory bonuses when you first open an account. This typically takes the form of “spend a certain amount of money within a certain amount of time and we’ll give you a reward.” These can be great if the card is a good fit for you and you are planning to spend that amount of money already.

Which is Better: Points or Cash Back

This answer depends on your financial situation. Cash back can be thought of as a discount on purchases, and can be helpful if you are strapped for cash because it allows you to use cash back instead of actual cash if you are in a pinch. Because of the possibility for higher redemption value, points can often provide a better return if you are not as worried about having the cash to pay your credit card bill. *While many points-based cards offer the option to redeem points for a discount on your bill, this is often a low-value way to redeem points, so you should always do the math on the different options available.*

Many of the highest redemption value options for points are for travel, so if you are a homebody, it is worth doing the research to see what redemption options you will actually use because a cash back card may end up be a better fit for you than a card that offers points.

I find that the best way to compare rewards programs is to figure out a rough value of the points that each choice offers, and then compare that to the cash back that is offered. If a card is offering 4% cash back or 4 points per dollar and I can get roughly 1.5¢ of value from each point, those 4 points will get me roughly 6¢ per dollar spent as opposed to 4¢ per dollar if I choose the cash back card. I can then use that to compare the rewards more easily!