Picture this: you pack a snowball and plop it down onto the snowy ground. You pack a bit more snow onto it, and then roll it down the hill in front of you. What happens as it rolls down? It gathers more snow, and it grows. The farther it rolls, the more snow it picks up. By the time it reaches the bottom, your once-little snowball is gigantic.

What if I told you that it works the same way with money?

The financial term for this effect is compounding. Compounding refers to the cycle of earning income from an investment, and then putting that money back into an investment so that it generates more income. This income is then reinvested again, which generates more income, and so on and so forth.

“That sounds boring. What’s the point of making money if you don’t get to spend it?”

Let’s say that you inherit $10,000. You consider three options:

- Option #1: spend the $10,000 right away

- Option #2: buy $10,000 worth of a stock and spend the dividends from it

- Option #3: buy $10,000 worth of a stock and reinvest the dividends from it until you retire

Let’s see how each of these scenarios plays out.

Option 1: you spend the $10,000, and you have the thing that you spent the money on, but no more money or income from it.

Option 2: every year, you get $1,000 worth of dividends from your stock, which you then spend. After 40 years, you are still making $1,000/year without having to work for it, plus you still have your original $10,000.

Option 3: That stock pays a 10% dividend, so by the end of the year, you have $1,000 cash from the dividends. You then take that $1,000 and buy more stock. The next year, you get 10% of $11,000 (original $10,000 + $1,000 from dividends), which is $1,100. You then take that $1,100 and buy even more stock. Now you get $1,210, which you then roll back into more stock. You’re making a little bit of money, but after three years, you’re only making $210 more than if you had spent the dividends on something fun and kept collecting 10% of $10,000. Why not just spend it?

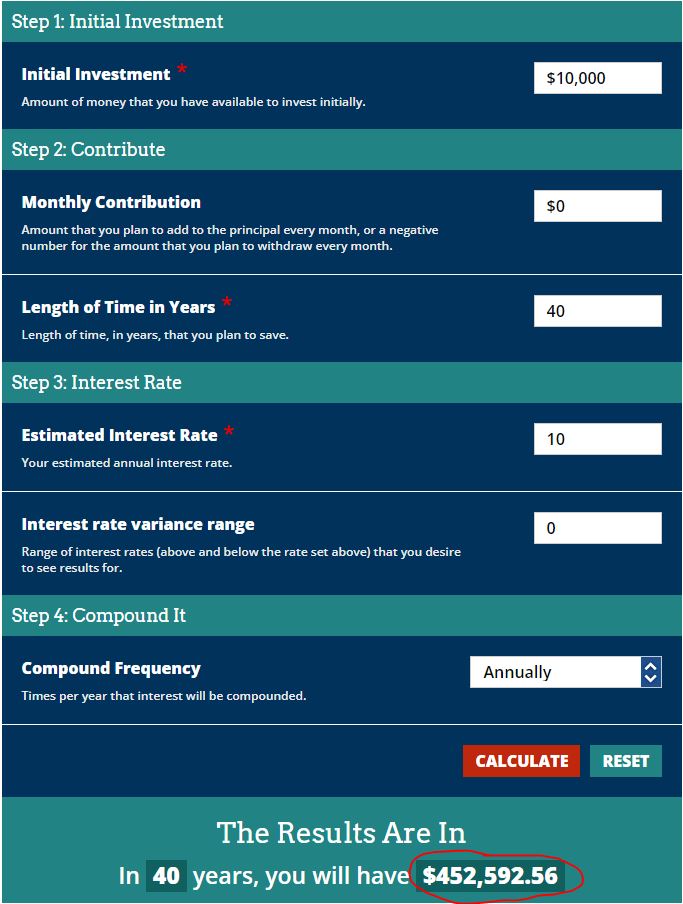

Let’s take a look at what happens if you do the same thing for 40 years. You can figure this out this calculator.

As you can see, if you don’t contribute any other money besides the initial $10,000, earn 10% every year, and let the money grow for 40 years, that $10,000 ends up being worth $452,592.56! By now, you are bringing in $45,259.25 each year in income from your dividends.

These numbers only goes up if you add more money to your investments as well. For instance, if you start adding $500 per month and leave all of the other numbers the same, after 40 years, you end up with an investment worth $3,108,147.89 and $310,814.79 of dividend income!

These numbers don’t factor in taxes, which decrease the end amounts. However, you can minimize the effects of taxes by using retirement accounts like your 401k/403b and your IRA.